Road tax is part of your vehicle ownership tax. Every registered vehicle in Singapore must have valid road tax.

At a glance

| Understanding road tax |

As a vehicle owner, you must renew the road tax for your vehicle every 6 or 12 months.

When you buy a vehicle, check with the seller if the road tax for your vehicle is already paid.

When you sell a vehicle, any remaining road tax on the vehicle will be transferred to the new owner.

When you deregister a vehicle, any remaining road tax on the vehicle will be refunded to the last registered owner. |

| Renewing your road tax |

Ensure that your vehicle meets all the renewal prerequisites at least 1 working day before renewing your road tax.

Find out how much road tax you need to pay, including any surcharges.

There are 4 different ways to renew your road tax:

There will be late renewal fees and other penalties for late renewal. |

| Related digital services |

Enquire Road Tax Payable/Prerequisite(s) To Fulfil Calculate road tax via engine capacity and vehicle’s age

To view or print road tax payment receipts for payments in the last 3 months, login to your dashboard. |

| Find out more |

Learn more about vehicle tax structure here. |

Understanding road tax

You can renew road tax for 6 or 12 months. Before you can renew your road tax, you must meet the renewal prerequisites. Your vehicle must:

- Be insured for the period of road tax you are paying

- Pass the required vehicle inspection, if it is due

- Clear any outstanding fines

If an inspection is due, you will receive a notice.

For Weekend Cars/Off-Peak Cars/Revised Off-Peak Cars and Heavy Vehicles, there may also be additional prerequisites to meet. The road tax of Weekend Cars/Off-Peak Cars/Revised Off-Peak Cars can only be renewed on a 12-monthly basis.

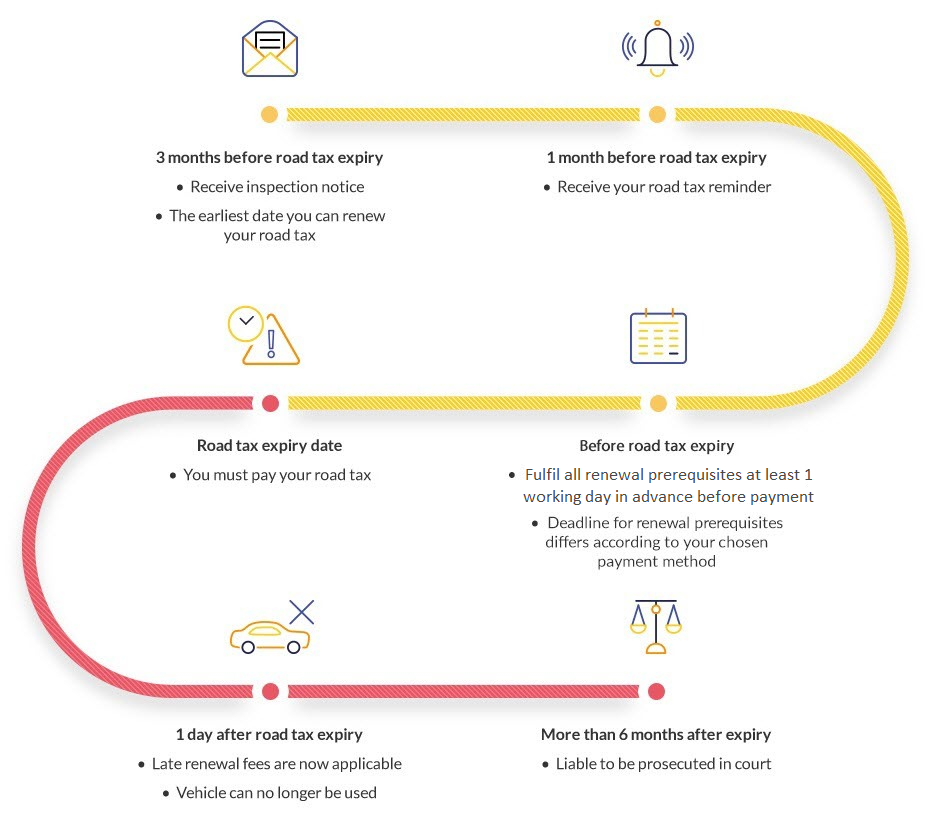

Road tax timeline and what you need to do

From 15 February 2017, you no longer need to display your road tax disc on your vehicle windscreen. Please remove your expired road tax discs.

If you are travelling to Malaysia, please keep a valid copy of your vehicle’s certificate of insurance, and a PDF copy or printout of your latest road tax validity, in your vehicle.

Download or print your road tax validity

When you buy a vehicle

If you are buying a new vehicle, your road tax may be included in the total cost. Please check with your motor dealer.

If you are buying a used vehicle, please check that it has valid road tax before you drive it. The vehicle may come with road tax.

Check the expiry of your vehicle’s road tax here

When you sell or deregister your vehicle

You have to renew your road tax if it expires before you can sell or deregister your vehicle.

When a vehicle is sold, any road tax that has been paid will follow the vehicle and be transferred to the new owner. You can consider factoring in the unused road tax into the selling price of your vehicle.

When a vehicle is deregistered, any unused portion of the road tax that has been paid will be automatically refunded to the last registered owner.

How to renew your road tax

You can pay online or via AXS services, GIRO or at Authorised Road Tax Collection Centres (From 1 February 2025, cash, cheque and cashier’s order are not accepted for road tax renewals at all Inspection Centres).

Before you renew your road tax, meet all your renewal prerequisites at least 1 working day in advance.

You have to renew your road tax before it expires, or you will have to pay late renewal fees and fines. You may also be charged in Court for keeping an unlicensed vehicle.

Renewal prerequisites

Before you can renew your road tax, you have to meet these prerequisites:

- Vehicle insurance coverage

Make sure your vehicle is covered by insurance for the entire period you are paying road tax. The vehicle insurance must cover third-party liability for deaths and bodily injury. It is a serious offence for a vehicle to be driven without insurance coverage.

- Vehicle inspection (if one is due)

If your vehicle is due for periodic inspection, you will receive an inspection notice about 3 months before your road tax expires. If you have misplaced your inspection notice, you can still get your vehicle inspected at LTA-Authorised Inspection Centres without it.

- Outstanding fines from LTA, HDB, URA and Traffic Police (TP)

If your vehicle has outstanding fines or warrants from LTA, HDB, URA and TP, it may prevent you from renewing your road tax. To renew your road tax smoothly, ensure that your vehicle has no outstanding fines or warrants with these agencies.

- For Weekend Cars / Off Peak Cars / Revised Off Peak Cars

Inspect your vehicle number plate seals at an LTA-Authorised Inspection Centre. Road tax for these vehicles can only be renewed on a 12-monthly basis.

- For heavy vehicles

Heavy vehicles must have a valid Vehicle Parking Certificate (VPC). Your vehicle is considered a heavy vehicle if it is:

- A vehicle with a maximum laden weight more than 5,000kg

- A bus with seating capacity more than 15 passengers

- A trailer or a mobile crane

- A recovery vehicle with unladen weight more than 2,500kg

How to check the road tax amount to pay

You can check how much road tax to pay by entering your Vehicle Registration Number, or your vehicle's engine capacity and age using the digital services below.

Road tax surcharge for vehicles over 10 years

For vehicles of more than 10 years old, you have to pay a road tax surcharge on top of your vehicle's original road tax.

| Age of vehicle |

Annual road tax surcharge |

|---|---|

| More than 10 years old |

10% of road tax |

| More than 11 years old |

20% of road tax |

| More than 12 years old |

30% of road tax |

| More than 13 years old |

40% of road tax |

| More than 14 years old |

50% of road tax |

1. Online at OneMotoring (available all day except between midnight and 1.00am)

2. AXS Services (available all day except between midnight and 1.00am)

3. GIRO

4. At Road Tax Collection Centres

Late renewal fees

Avoid paying additional late renewal fees by renewing your road tax before it expires.

Besides late renewal fees, it is also an offence to keep or use a vehicle whose road tax has expired. The penalty includes a fine up to $2,000.

Check how much late renewal fees you may be charged below.

Cars |

||||

|---|---|---|---|---|

Engine Capacity |

Within 1 month of expiry date |

Between 1 and 2.5 months |

More than 2.5 months |

More than 3 months |

≤1,000cc |

$10 |

$60 |

$80 |

$230 |

1,001–1,600cc |

$20 |

$70 |

$90 |

$240 |

1,601–2,000cc |

$30 |

$80 |

$100 |

$250 |

2,001–3,000cc |

$40 |

$90 |

$110 |

$260 |

≥3,001cc |

$50 |

$100 |

$120 |

$270 |

Business service passenger vehicles (company cars) |

||||

|---|---|---|---|---|

Engine Capacity |

Within 1 month of expiry date |

Between 1 and 2.5 months |

More than 2.5 months |

More than 3 months |

N.A. |

$50 |

$100 |

$120 |

$270 |

Motorcycles |

||||

|---|---|---|---|---|

Engine Capacity |

Within 1 month of expiry date |

Between 1 and 2.5 months |

More than 2.5 months |

More than 6 months |

<300cc |

$10 |

$30 |

$50 |

$130 |

≥300cc |

$10 |

$60 |

$80 |

$230 |

Other vehicle types |

||||

|---|---|---|---|---|

Engine Capacity |

Within 1 month of expiry date |

Between 1 and 2.5 months |

More than 2.5 months |

More than 3 months |

N.A. |

$50 |

$100 |

$120 |

$270 |